Congratulations on your Disney Vacation Club purchase! Being a DVC member comes with so many perks–it’s well worth the investment. Beyond your initial contract payment, each year you owe annual dues. You can think of annual dues like a home owners association. Annual dues go toward your Home Resort’s operating costs, administrative expenses, refurbishment expenses, and real estate taxes. Annual dues are assessed for each Home Resort, so do differ between home resorts. However, annual dues at any given Home Resort are the same no matter how you purchased your contract–folks who saved loads of money on their initial purchase by buying their Home Resort contract through DVC Shop’s resale listings pay the exact same rate of annual dues as those who buy directly through Disney.

Annual dues are typically billed in mid- to late-December and due on January 15 of each year. Annual dues are calculated based on the calendar year and are not at all related to your Use Year. The amount you owe in annual dues is determined by your Home Resort and the number of points on your contract. Read more information on the 2025 annual dues rates per point at the various Home Resorts.

Locating Your Annual Dues Statement

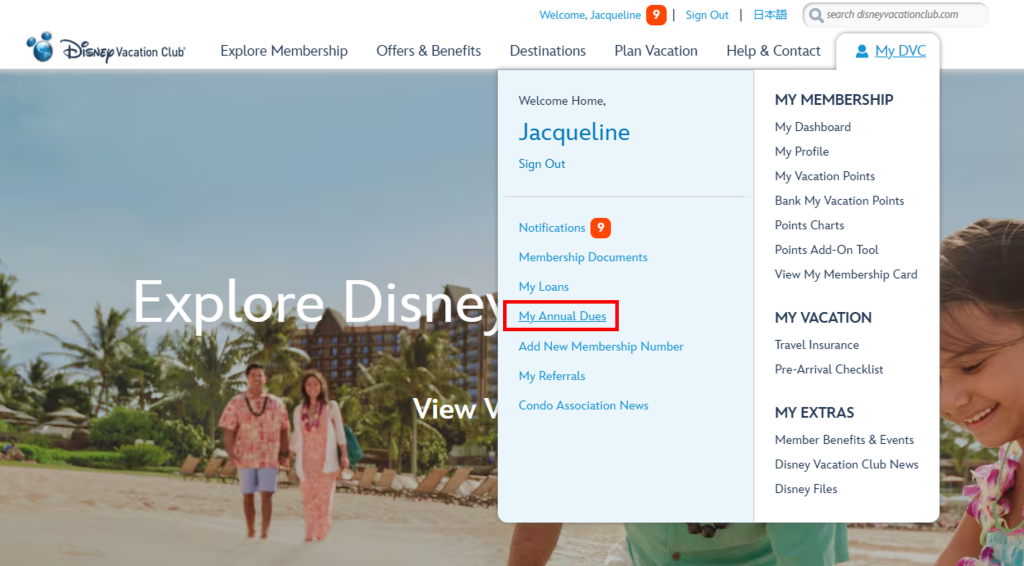

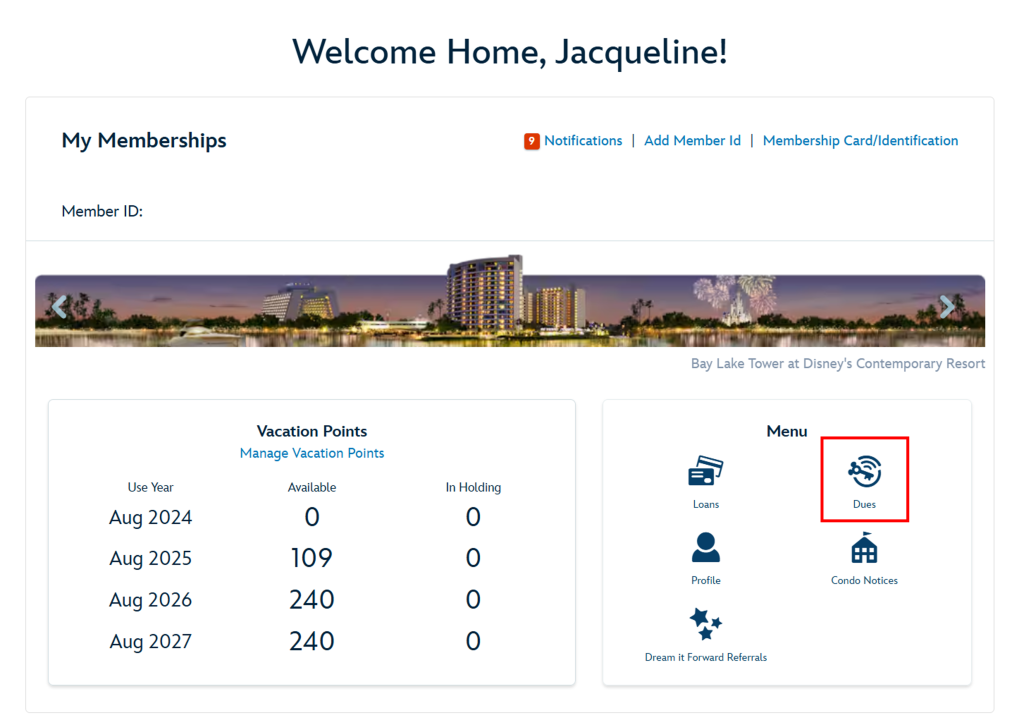

Your annual dues statement will be mailed to you and you can also access it online. After you login to the Disney Vacation Club member portal, you can easily access your annual dues statement two ways:

First, hover over the “My DVC” dropdown menu, then select “My Annual Dues” on the lefthand panel.

Second, from your Member Dashboard, you can select “Dues” in the menu on the right.

Then either in the mailed version or the online statement, you can look at further details to better understand the annual dues you owe.

Viewing Your Annual Dues Statement

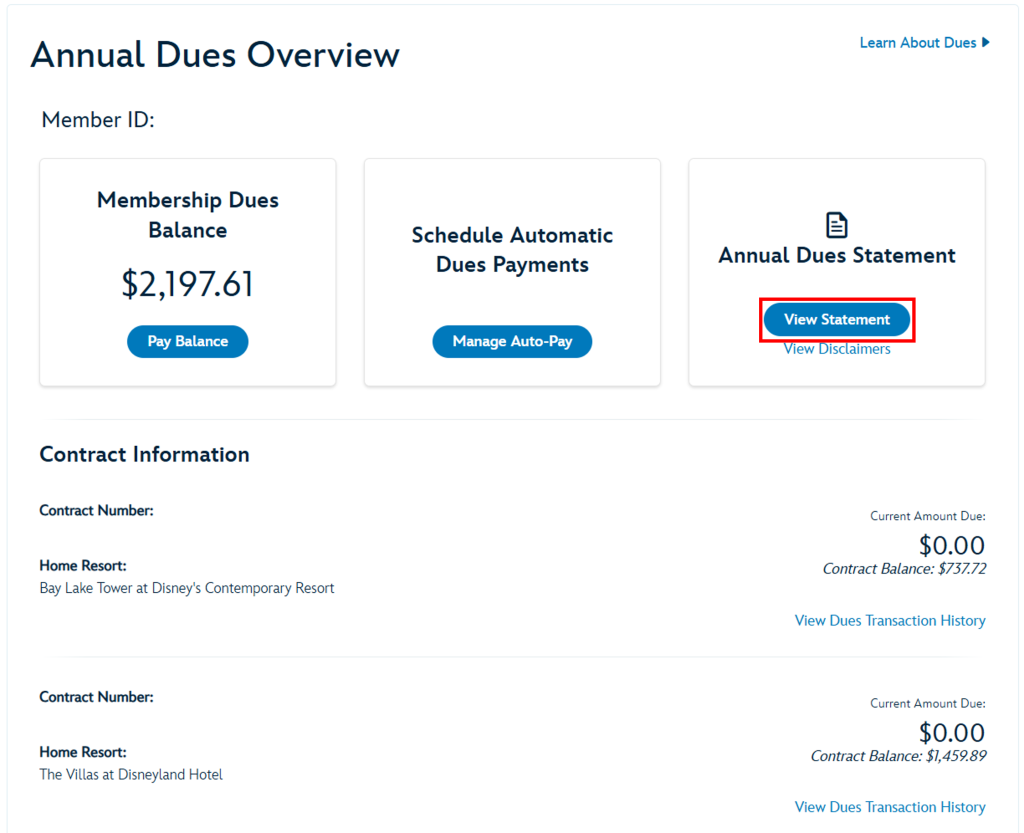

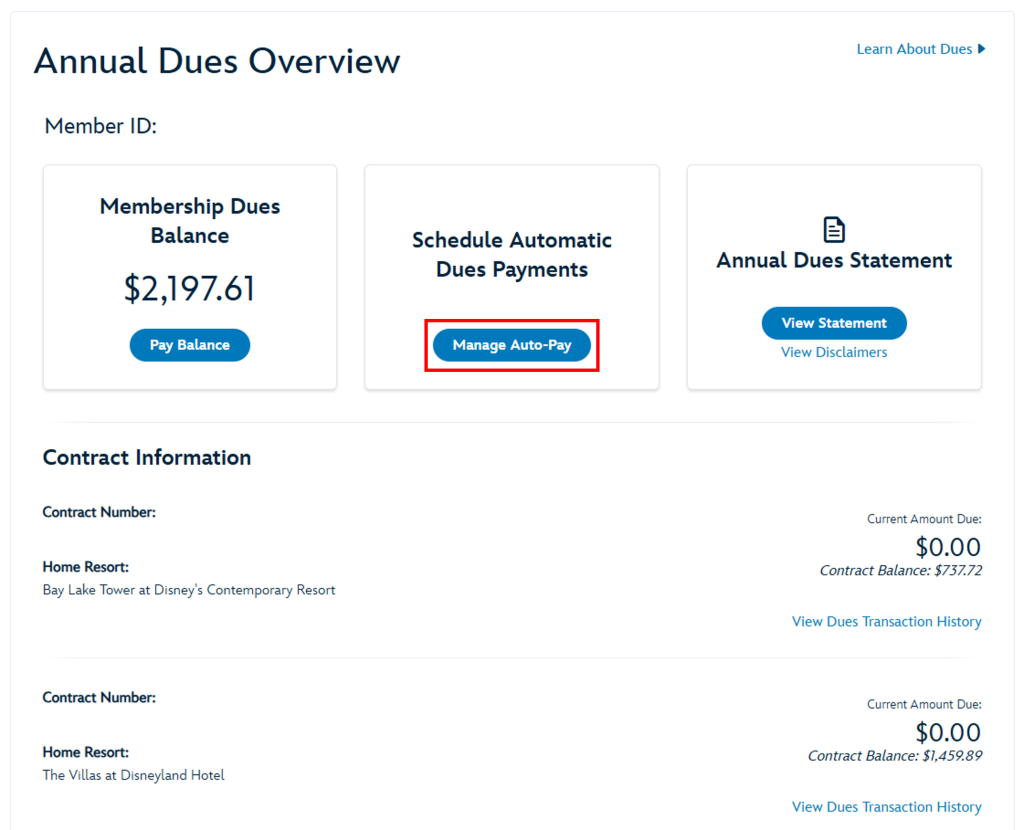

If you navigate to your annual dues online via either method above, you’ll be taken to your annual dues overview. Here you can see I have two Home Resorts, Bay Lake Tower and Villas at Disneyland Hotel. My annual dues are assessed for each Home Resort separately. To learn more, click “View Statement.”

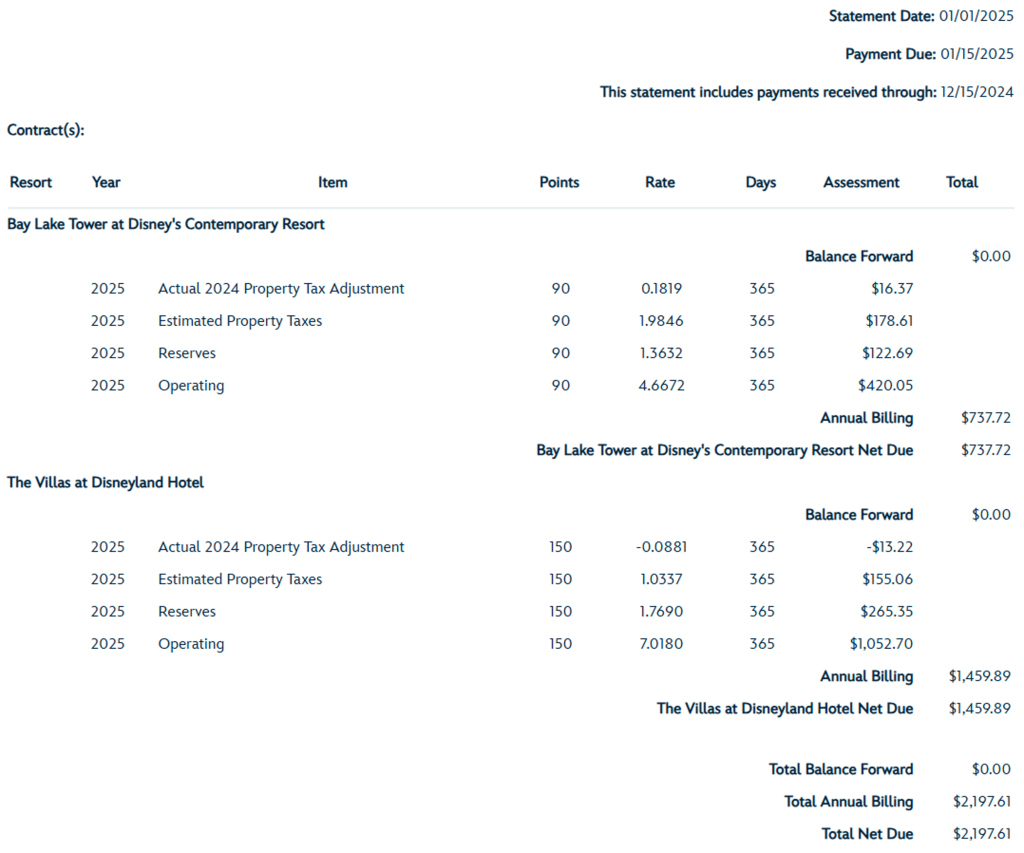

The annual dues statement provides an additional level of detail for your annual dues.

Often, the first line is going to be an adjustment from the prior year. Annual dues are assessed in December prior to the calendar year they are actually for. For example, the current calendar year 2025 dues were assessed in December 2024. Therefore, these are always an estimate. There are usually small changes in the actual property taxes assessed, and that occurs after the annual dues statement is sent out. This difference is then applied to your next annual dues statement. You can see my two Home Resorts have different 2024 adjustments. For my Bay Lake Tower contract, I actually owe a bit more–$0.1819 more per point–as the 2024 property taxes were underestimated when I paid my 2024 annual dues. At the Villas at Disneyland Hotel, my adjustment is actually in my favor: it’s -$0.0881 per point, meaning the 2024 estimated taxes I paid last year were an overestimate, so now I receive a credit on my 2025 annual dues statement to correct for this.

Then you will see your estimated property taxes for the upcoming calendar year, the reserves rate per point, and the operating costs per point. Combined, these make up your annual dues. If you want to understand further details of the cost components, you can refer to the budget for your Home Resorts. This is included in the mailed notice sent to your home address, and can also be accessed online by navigating to the Condominium Association News & Notices webpage.

Once you understand your annual dues, its time to pay your statement. There are two cadences of payment: in one lump sum or monthly payments.

Monthly Annual Dues Payments

From your annual dues overview page, you can select “Manage Auto-Pay” in the main menu.

From there, you will select the Home Resort(s) you want to enroll in automatic dues payments. Then you choose the frequency (annually or monthly), and if monthly you choose if the draft date is the 1st or 15th of each month. You’ll then add your payment method, which must be a U.S. bank account–either a checking or savings account is acceptable. There are no additional fees assessed if you choose to pay your annual dues on a monthly cadence, but do note that the U.S. bank must be on U.S. soil and U.S. bank accounts with a foreign bank do not qualify.

Choosing to pay your annual dues monthly divides the total dues amount into 12 (nearly) equal installments, and again no interest or extra fees are assessed for this service. This can be a fantastic way to split up a large payment over the entire year. Do note if you want to do monthly payments that you need to set up your auto-pay method by January 31. If you would like to pursue this method, read more details on how to set up monthly auto-pay for your DVC annual dues.

Lump Sum Annual Dues Payment

Instead of monthly installments, you can choose to pay your annual dues in one lump sum. As mentioned earlier, these are technically due January 15 of each year. However, historically Disney Vacation Club has provided a one-month grace period before assessing late fees, meaning you have until February 16 until dues are considered late.

Paying Annual Dues Online

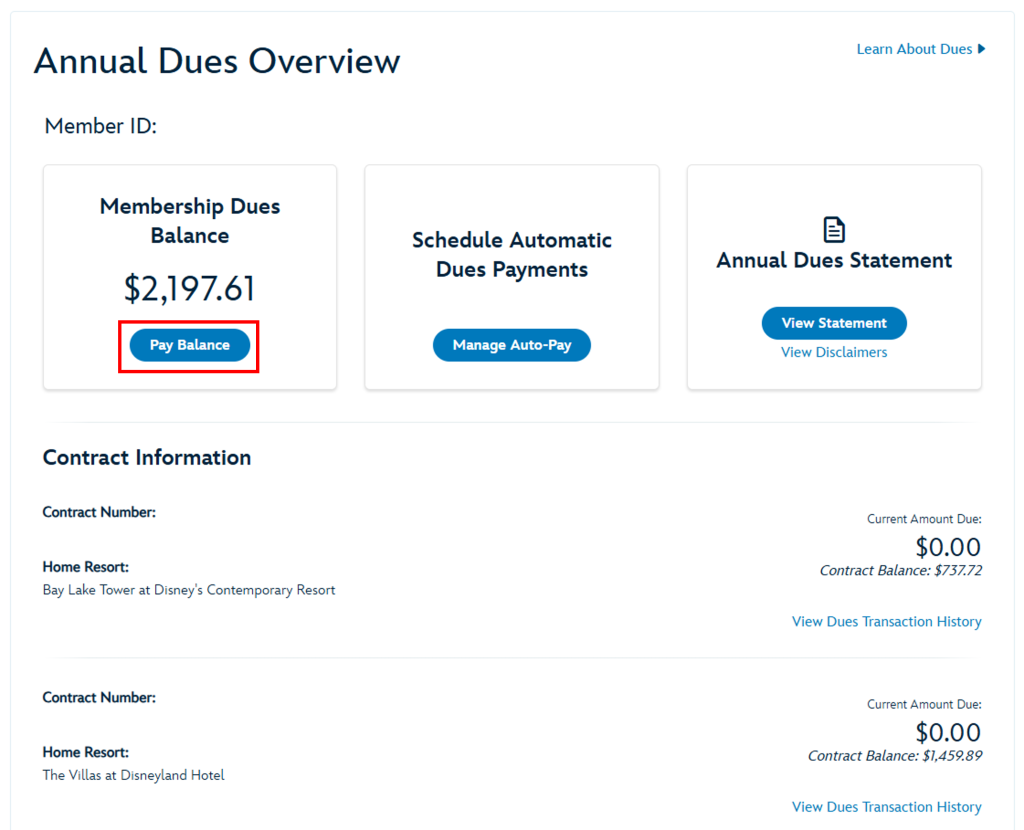

When paying monthly, your only option is debits straight from a bank account. In contrast, for lump sum payments, there’s a variety of payment methods you can utilize. You can pay using one or more credit cards, debit cards, Disney gift cards, and Disney Rewards Redemption card. To start the process online, select “Pay Balance” in your annual dues overview.

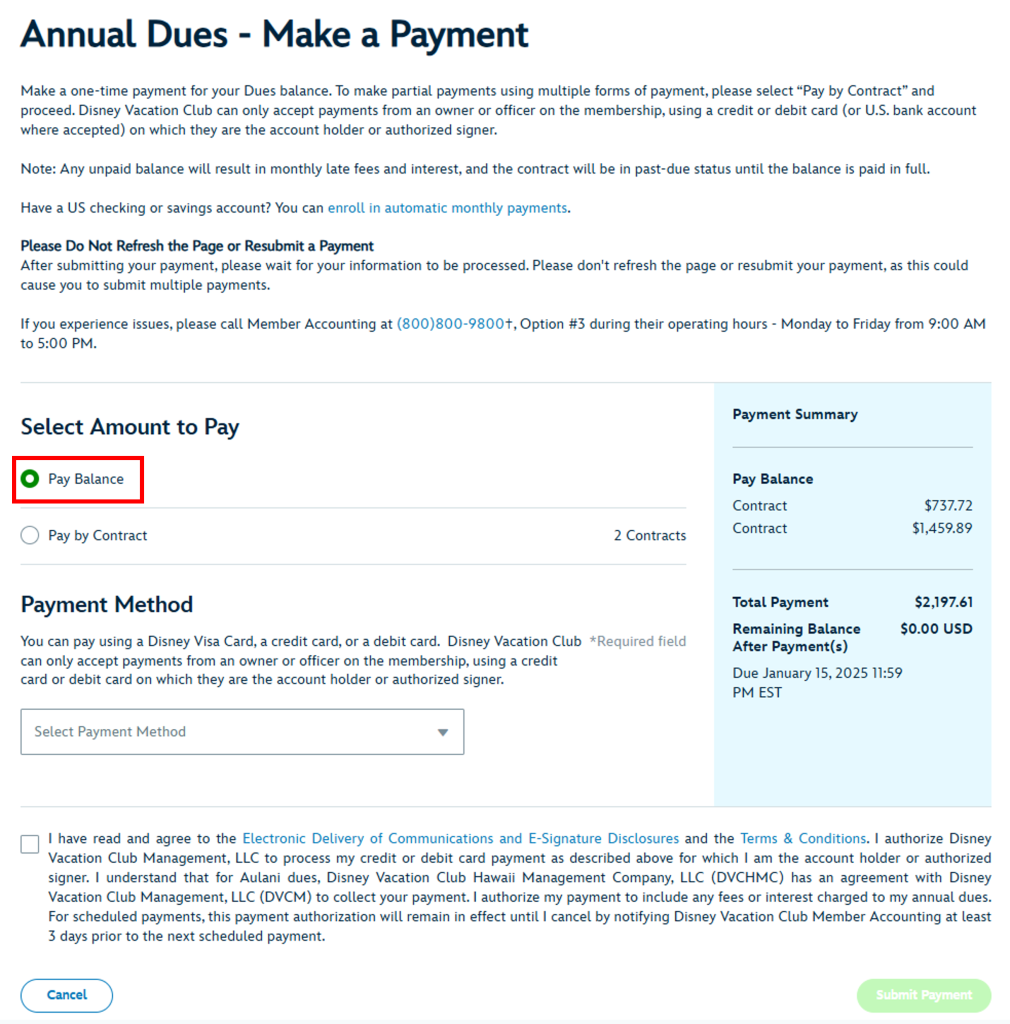

If you want to pay your full balance through one method, for example putting it all on a single credit card, select “Pay Balance,” enter your payment method, and submit the payment.

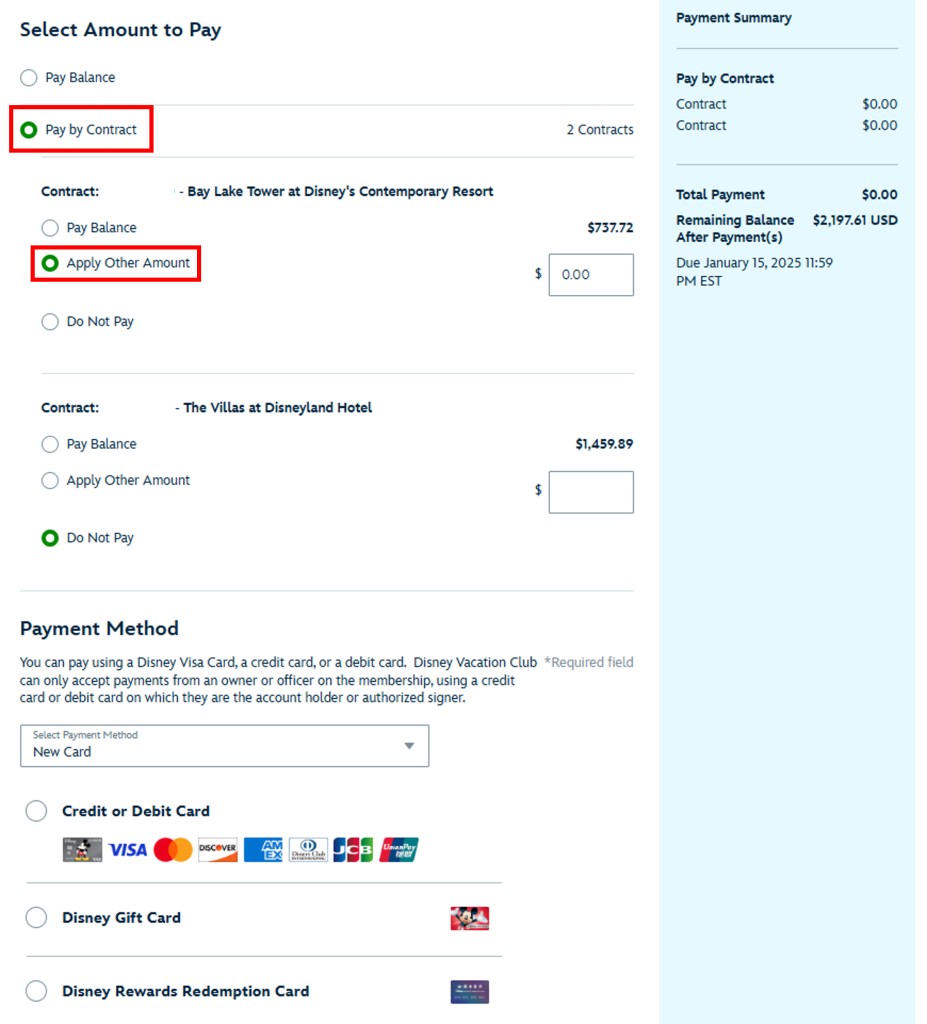

If you would rather break up your payment among multiples methods–for example, a combination of Disney Gift Cards, Disney Reward Redemption card, and credit card payments, instead choose “Pay by Contract.” Even if you only have one contract, this is how you proceed with multiple payment methods. From there, rather than pay the entire balance you can choose to “Apply Other Amount.”

You may have $200 in Disney Gift Cards and $30 on your Disney Reward Redemption card. This likely is not enough to pay your annual dues in full, but you can enter those smaller amounts through this “Apply Other Amount” method, and simply make several transactions to pay off your annual dues. This is a great way to make use of Disney Gift Cards you have collected over the year perhaps as gifts and perhaps when they go on sale at retailers like Target and Sam’s Club. This is also a fantastic method to use up Disney Rewards you have accrued from your Disney Visa credit card. Then you can strategically choose what credit or debit card to put the remainder on. I personally use my lump sum annual dues payment as an opportunity to hit spending amounts on credit card sign up bonuses or rack up a lot of points on an existing credit card.

Paying Annual Dues via Phone or Check

If you would rather not pay your annual dues statement online, you can also call Member Services. Dial (800) 800-9800 and select option 3 to pay by phone. You can also send a check to:

DVC Association Manager

28397 Network Place

Chicago, IL 60673-1283

To avoid late charges, ensure you allow for at least 7 days of mailing time. And note that any payments that are returned by your bank will have an insufficient funds fee of $25 charged to your account.

Overall, paying your annual dues can be very straightforward and an easy process. If you have any questions, leave those in the comments below!